Refinancing Your Home. Good Idea or Risky Gamble?

The current low interest rates can make it a great time for some homeowners to refinance. What’s important to note is that changes in interest rates affect fixed and adjustable mortgages differently.

While adjustable rate mortgages may be affected by short-term rate changes, fixed mortgage rates tend to be more closely aligned with the 10-year Treasury note.

If you have an ARM, a decrease in the short-term federal funds rate may lower your rate. If you have a fixed-rate mortgage, you should instead pay attention to long-term bonds like the 10-year Treasury note.

Rates aside, deciding whether or not to refinance depends on a number of personal factors.

WHAT’S YOUR GOAL?

Do you want to lower your monthly payment? Reduce the length of your mortgage? Take out extra money for home improvements? These are important initial questions.

If decreasing your payment is a top priority and you can lower your interest rate by .5 to 1 percent, it’s probably worth the effort. For instance, lowering the interest rate on a $350,000 30-year fixed mortgage by 1 percent could lower your monthly payment by about $300 a month.

On the flip side, if your goal is to shorten the length of your mortgage and you refinance that amount for 15 years, your monthly payment would go up, but you’d save a considerable amount in interest over the life of the loan.

HOW LONG WILL YOU BE IN THE HOUSE?

Refinancing usually involves paying points and fees. Points basically represent interest you pay upfront to get a lower rate on your loan. It’s not uncommon for points and fees to add up to 3-6 percent of your loan. You can pay this out of pocket or, often times, add them to the balance of your loan.

However you pay them, it will take time to get to the breakeven point where these additional costs are offset by the lower rates, so you have to think realistically about how long you intend to be in your home. If you plan to sell in the near future, the extra cost of refinancing may outweigh the monthly short-term savings.

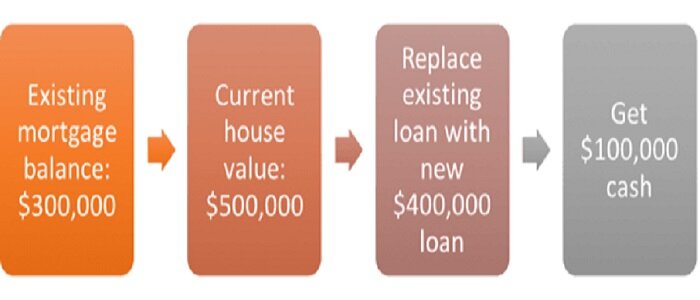

HOW MUCH HOME EQUITY DO YOU HAVE?

Do you want to lower your monthly payment? Reduce the length of your mortgage? Take out extra money for home improvements? These are important initial questions.

If decreasing your payment is a top priority and you can lower your interest rate by .5 to 1 percent, it’s probably worth the effort. For instance, lowering the interest rate on a $350,000 30-year fixed mortgage by 1 percent could lower your monthly payment by about $300 a month.

On the flip side, if your goal is to shorten the length of your mortgage and you refinance that amount for 15 years, your monthly payment would go up, but you’d save a considerable amount in interest over the life of the loan.

DO THE MATH

Refinancing usually involves paying points and fees. Points basically represent interest you pay upfront to get a lower rate on your loan. It’s not uncommon for points and fees to add up to 3-6 percent of your loan. You can pay this out of pocket or, often times, add them to the balance of your loan.

However you pay them, it will take time to get to the breakeven point where these additional costs are offset by the lower rates, so you have to think realistically about how long you intend to be in your home. If you plan to sell in the near future, the extra cost of refinancing may outweigh the monthly short-term savings.

Refinancing usually involves paying points and fees. Points basically represent interest you pay upfront to get a lower rate on your loan. It’s not uncommon for points and fees to add up to 3-6 percent of your loan. You can pay this out of pocket or, often times, add them to the balance of your loan.

However you pay them, it will take time to get to the breakeven point where these additional costs are offset by the lower rates, so you have to think realistically about how long you intend to be in your home. If you plan to sell in the near future, the extra cost of refinancing may outweigh the monthly short-term savings.

This post was excerpted from an online article by Carrie Schwab-Pomerantz, Board Chair and President, Charles Schwab Foundation, Senior Vice President, Charles Schwab & Co., Inc. and Board Chair, Schwab Charitable